United Way of Central West Virginia

Earned Income Tax Credit (EITC) helps millions of workers keep more of what they earn to pay for things like reliable transportation to get to work, housing, and food, and many United Way helps people claim the EITC at tax time.

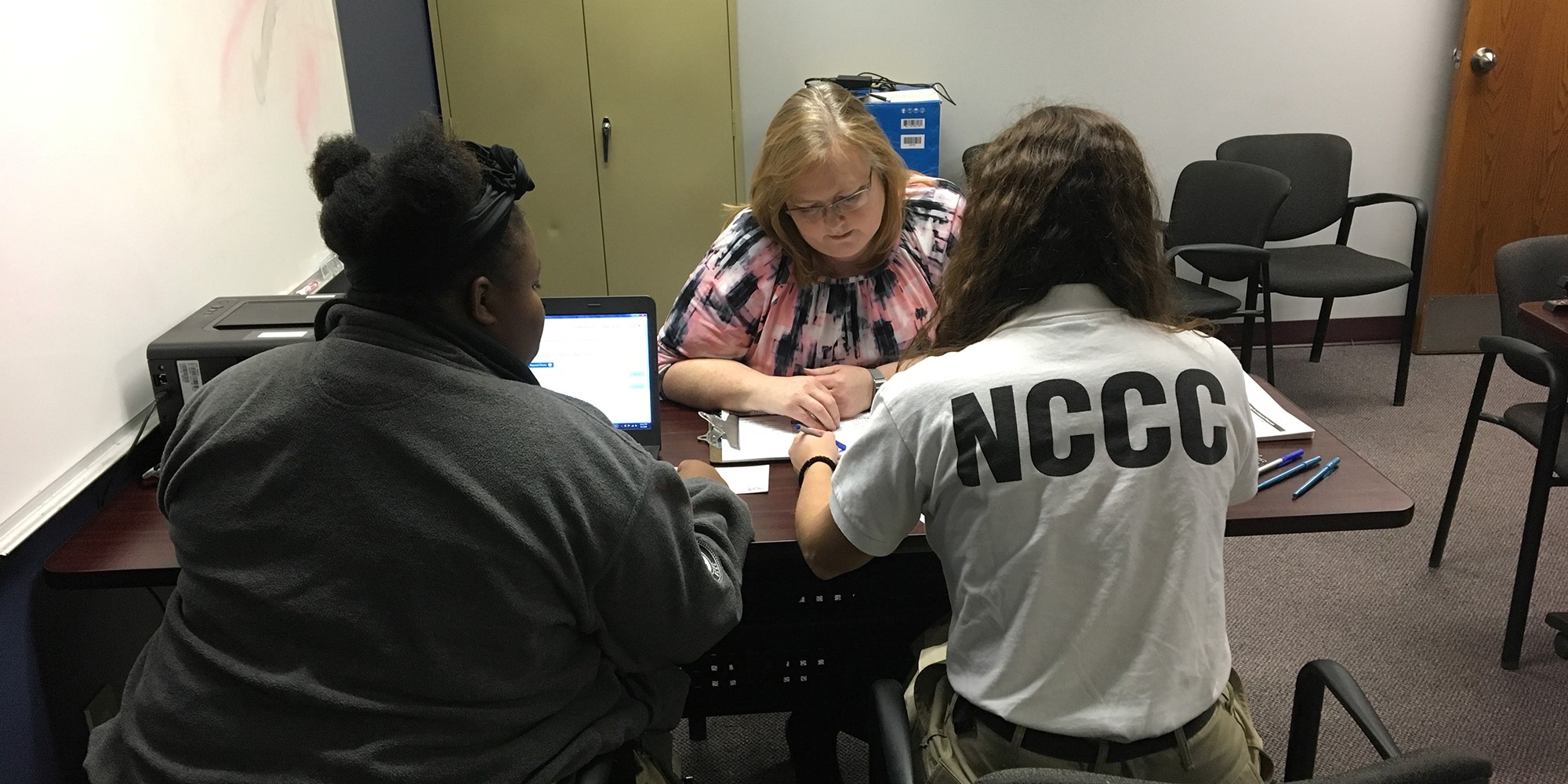

In Charleston, West Virginia, AmeriCorps National Civilian Community Corps (NCCC) Team River 1 is working with United Way of Central West Virginia to prepare tax returns for community members of central West Virginia with a special emphasis on low to moderate income people that qualify for the Earned Income Tax Credit (EITC).

All nine members of River 1 are certified as basic preparers by the IRS with two members also having an advanced certification.

For more information, contact: Cassandra Curtis, United Way of Central West Virginia, ccurtis@unitedwaycwv.org